Study Commissioned by Pharmaceutical Industry Association Reveals Impact

The important role played by the biopharmaceutical industry in Puerto Rico should not be relegated to simply a sector that creates jobs and collects millions of dollars for the treasury. Rather, it should be seen as a long-term investment that not only represents an important driver for the island’s economy, but also provides additional long-term benefits that assist greatly in the economic development of Puerto Rico.

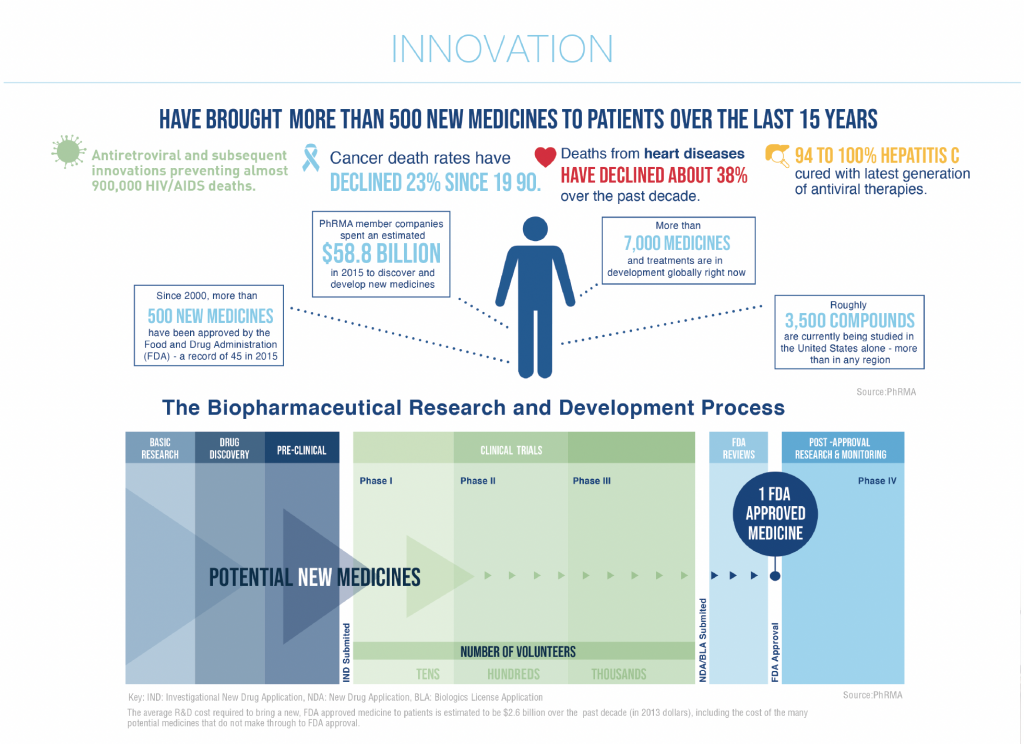

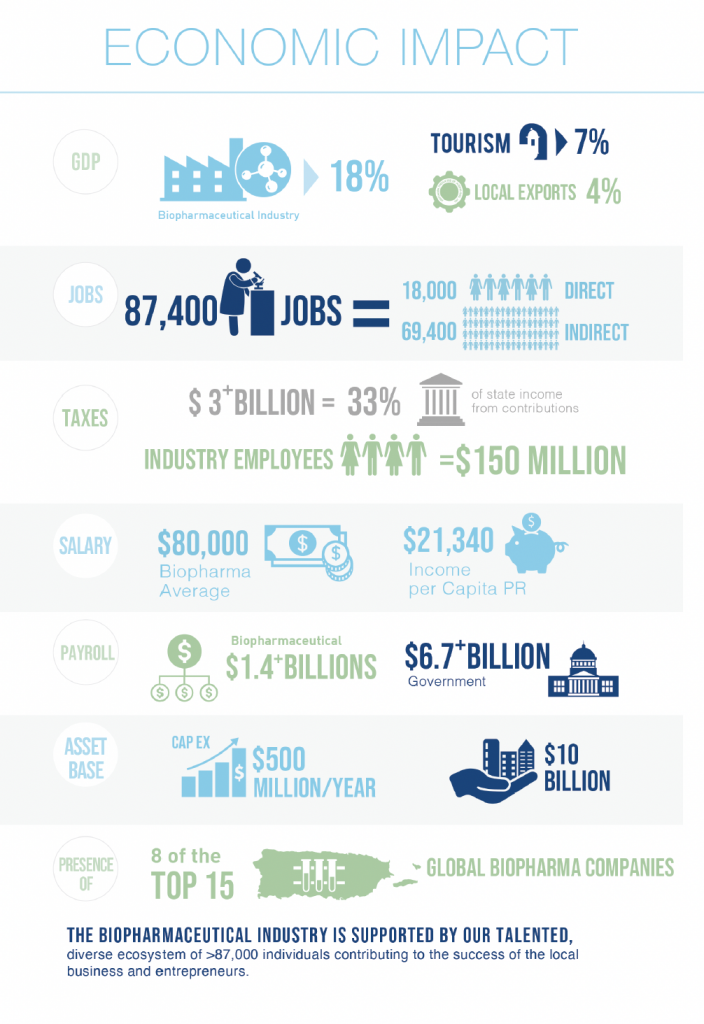

That was established last week during an industry analysis presented by Estudios Técnicos to the Pharmaceutical Industry Association of Puerto Rico (PIA). Leslie Adames, director of analysis and economic policy at the research firm, gave an update on the impact of the industry, which represents $10 billion in capital in-vestments, injects $500 million in the maintenance of its facilities each year and procures some $750 million annually in local products and services. Likewise, it contributes more than $3 billion in taxes to the treasury, which represents about 37 percent of the Puerto Rico government’s revenue. “The biopharmaceutical industry con-tributes 18 percent of the gross domes-tic product and generates more than 87,400 direct and indirect jobs on the island,” Adames noted. “This includes 18,000 direct jobs in different pharmaceutical companies that operate locally and whose employees contribute more than $150 million in taxes annually.” “It is estimated that the average sal-ary of employees in the industry is $80,000 a year and the payroll is over $1.4 billion annually. The industry sources local products and services that are valued at more than $750 mil-lion annually,” he added.

According to the economist, Puerto Rico produces four of the 20 main medicines that are consumed glob-ally and, in total, 11 of the 20 main biopharmaceutical companies in the world have manufacturing operations on the island, specifically in 11 municipalities where they create jobs; economic activity; pay “patentes,” or economic activity; and invest in community and educational programs.

More than Revenue and Jobs

However, beyond the industry’s potential for immediate economic development, its long-term impact rep-resents a matter of equal importance for the socioeconomic development of the island. As explained to Caribbean Busi-ness by José Joaquín Villamil, the CEO and president of Estudios Técnicos, there are equally important impacts, but in the long term, that are fundamental for the economic development of Puerto Rico.

“The projection of Puerto Rico abroad, that image, is a bit tarnished and the biopharmaceutical industry is a very positive element because these are industries that I call ‘gateway industries,’ in the sense that they are the introduction of the island to the rest of the world and it is important that the first face they see is the pharmaceutical industry, which is such a highly regulated industry, where quality is an important element and Puerto Rico meets those requirements,” Villamil explained.

“The other important aspect is that it has been the incubator for many Puerto Rican industries, for example, Paciv Inc. and Pharma-Bio Serv, which are examples of local companies that emerged thanks to the fact that the pharmaceutical industry on the island stimulated the creation of these companies,” he added. According to the report, 75 percent of the employees who work in this industry have a university degree and many have received their education and training in Puerto Rico and work to safeguard the medicines that are distributed in Puerto Rico and around the world. Likewise, it was indicated that, to foster the development of local talent, the biopharmaceutical industry offers its employees professional development opportunities through leadership and mentoring programs, scholarships, sponsorship of universities and student organizations, intern-ship experiences, summer camps and other efforts. An example is the University of Puerto Rico’s Mayagüez campus, which offers a degree in chemical engineer-ing at its Center for Pharmaceutical Engineering Development and Learn-ing (CPEDaL) program with practical knowledge in pharmaceutical operations. For its part, the Polytechnic University of Puerto Rico also offers novel programs in chemical engineering. Likewise, high school students can attend the Pharmaceutical Engineer-ing Camp, PESCa, which provides them tools to recognize and under-stand different pharmaceutical processes by witnessing them firsthand. The students receive talks on chemical and pharmaceutical engineering, and participate in laboratory experiments such as characterization of raw materials and processes that range from mixing materials to tablet production and coating led by different mentors and CPEDaL students.

Community Impact

Stability and Certainty

For his part, Villamil assured that, despite the stability shown by the bio-pharmaceutical industry on the island, the truth is that improving certain aspects of the government framework is necessary for the broader establishment of this industry on the island to give investors certainty of where Puerto Rico’s economy is headed. The veteran economist stressed the importance of understanding that these investments in the pharmaceutical and biopharmaceutical industry are long-term projects that require government stability in terms of what he called “the rules of the game.”

“In Puerto Rico, we have not had a blueprint, a clear idea of where we want to take the economy and how to do it effectively, and I would tell you that looking to the future of this industry, with the offshoots it has with emerging research companies, it generates about $50 million annually in volume and also generates a pool of competent people who will be in great demand in the future,” Villamil pointed out.

“We need to have government stability and that surprising things such as Act 154 do not occur, that do not change the issue of regulation. That a biopharmaceutical company in Puerto Rico can count on stability in the rules of the game, and that gives confidence to these investors,” he added.

Villamil noted that investments in the pharmaceutical and biopharmaceutical sector have long gestation periods. “In other words, you don’t build a factory in two months, you don’t introduce a product in two months; these are things that take time, and because of that, the issues of stability, transparency in the rules of the game are fundamental,” he said.

However, the economist did not foresee that this industry could once again represent an economic boom for Puerto Rico similar to that of the times of section 936 of the Internal Revenue Code of 1954, when a tax credit generally equal to their federal tax liability was granted to U.S. companies that operated in Puerto Rico. This is be-cause the global scenario of this industry has changed dramatically in the past two decades.

“What is quite clear is that [biopharma] is an industry that used to be centered in the United States and two or three European countries, but now has a broader scope at a global level. The structure has also changed in the sense that many of the already established companies are acquiring smaller companies where a lot of innovation is developed,” Villamil explained.

“You often see news of companies like Pfizer or Eli Lilly buying small, unknown companies that produce innovation. Puerto Rico has to bet on this type of industry to strengthen the biopharmaceutical sector. The other thing is that when you look at the industry’s purchases locally, they are a lot, almost $800 million annually,” he added.

What are Biopharmaceuticals?

A biopharmaceutical product, also known as a biologic drug, is any pharmaceutical product manufactured, synthetically or semi-synthetically extracted from biological sources. Biopharmaceuticals include vaccines, blood, blood components, allergens, somatic cells, gene therapies, tissues, recombinant therapeutic proteins, and live cells used in cell therapy.

Biological products are composed of sugars, proteins and nucleic acids or complex combinations of these sub-stances. They can also be living cells or tissues. These products or their derivatives are isolated from living organisms, such as humans, animals, plants, fungi or microbes. Products based on genes or biological sources, for example, are at the forefront of biomedical research and can be used to treat a wide range of medical conditions for which no treatments are available.

In some jurisdictions, biopharmaceuticals are regulated by a variety of laws, categorizing them as small molecule drugs or medical devices.

One method for the production of biopharmaceuticals, however, involves transgenic organisms, mainly plants and animals that have been genetically modified to produce drugs. This production is of high risk for investors, due to the failures that may occur in the production or the scrutiny of the regulatory bodies based on the risks that may exist and the ethical implications. Biopharmaceutical crops also pose a risk of cross-contamination with non-modified crops or crops designed for medical purposes.